To become a financial risk manager, you will need to go through several steps. You must pass two rigorous exams and then work for two years in the industry. The FRM certification will demonstrate to employers that your risk management expertise is advanced and can add value in a variety specialized areas.

Qualifications are required

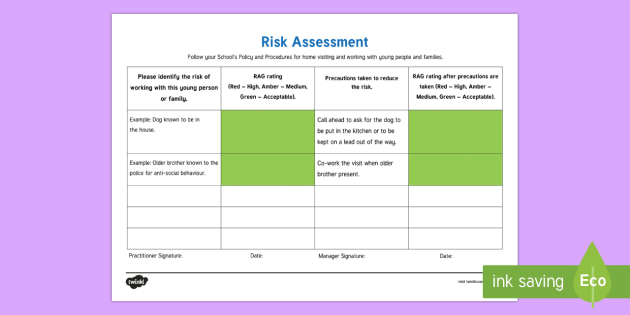

For a job as a financial risks manager, you must have an excellent understanding of business finance and be proficient in risk management. This position also requires a person with a keen eye for detail, including the ability to analyze data and identify trends. These skills will allow you to evaluate risk and make recommendations regarding risk mitigation.

To qualify for a position as a financial risk manager, you must have at least two years of full-time work experience in finance-related fields. Once you have enough work experience, you are eligible to apply for entry-level jobs at some of the most prestigious companies in the world.

Career outlook

If you are interested in working for a financial firm, you may want to consider a career as a financial risk manager. This job requires analytical and strategic thinking, a keen eye for risks, and a thorough understanding of technology. In addition, financial risk management professionals should be up to date on the latest developments in the industry, since they must constantly translate complex financial information into understandable terms.

Financial risk managers have a bright future. As the world economy and business landscape becomes more complex, so will the need for qualified individuals. People with experience in multiple industries and the ability of using data analytics effectively will make the best candidates. To communicate effectively with clients, they will need to have strong presentation skills.

Your job duties

A financial risk manager's job entails identifying and analyzing financial problems and reporting to senior management. The job also involves developing risk metrics, and implementing risk management strategy. The manager works closely with third-party providers of services, such brokers and insurers, to determine and evaluate potential exposures. This position also ensures compliance with insurance procedures, and risk management manuals.

The job requirements and duties of a financial manager can vary depending upon the employer. The manager may work in an office all day while others travel extensively to meet clients. The financial risk manager is required to work full-time and often for long hours in order to meet deadlines. This job requires a high degree of independence, as well as the ability handle pressure and take quick decisions. To stay current on financial markets, financial risk managers must be self motivated.

Training

Financial Risk Manager Training Program is designed for students to gain a fundamental understanding of risk and the tools and techniques needed to succeed in this field. These courses cover the core areas of risk-management, including markets, interest rates, derivatives, and market analysis. It also covers quantitative methods and analytical models. This program prepares graduates to work in many financial institutions.

The demand for risk management positions in the financial sector is high. Many financial companies are searching for qualified professionals to lead their departments of risk management. A strong risk management team is essential for all industries. However, earning a CFA or FRM certification is considered the gold standard in financial risk management and analysis.

FAQ

What are the three main management styles you can use?

There are three types of management: participative, laissez faire, and authoritarian. Each style is unique and has its strengths as well as weaknesses. Which style do you prefer? Why?

Autoritarian – The leader sets the direction for everyone and expects them to follow. This style is best when the organization has a large and stable workforce.

Laissez-faire - The leader allows each individual to decide for him/herself. This style is most effective when the organization's size and dynamics are small.

Participative: The leader listens to everyone's ideas and suggestions. This is a great style for smaller organizations that value everyone.

What is TQM exactly?

The industrial revolution was when companies realized that they couldn't compete on price alone. This is what sparked the quality movement. They needed to improve quality and efficiency if they were going to remain competitive.

To address this need for improvement management created Total Quality Management (TQM) which aimed to improve all aspects of an organization's performance. It included continuous improvement processes, employee involvement, and customer satisfaction.

What role does a manager have in a company's success?

Managers' roles vary from industry to industry.

The manager oversees the day-to-day activities of a company.

He/she is responsible for ensuring that the company meets all its financial obligations and produces the goods or services customers want.

He/she ensures that employees follow the rules and regulations and adhere to quality standards.

He/she plans and oversees marketing campaigns.

How do we build a culture that is successful in our company?

A successful company culture is one that makes people feel valued and respected.

It is based on three principles:

-

Everybody has something to offer.

-

People are treated fairly

-

Respect is shared between individuals and groups

These values are reflected by the way people behave. For example, they will treat others with courtesy and consideration.

They will respect the opinions of others.

They encourage others to express their feelings and ideas.

Additionally, the company culture encourages open communication as well as collaboration.

People feel free to express their views openly without fear of reprisal.

They understand that errors will be tolerated as long they are corrected honestly.

Finally, the company culture promotes integrity and honesty.

Everyone knows that they must always tell truth.

Everyone is aware that rules and regulations apply to them.

Everyone does not expect to receive special treatment.

Statistics

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

External Links

How To

How can you implement Quality Management Plan (QMP).

QMP (Quality Management Plan) is a system to improve products and services by implementing continuous improvement. It emphasizes on how to continuously measure, analyze, control, and improve processes, product/service, and customer satisfaction.

QMP is a common method to ensure business performance. The QMP aims to improve the process of production, service delivery, and customer relationship. A QMP should include all three aspects - Processes, Products, and Services. If the QMP only covers one aspect, it's called a "Process QMP". When the QMP focuses on a Product/Service, it is known as a "Product" QMP. If the QMP focuses on Customer Relationships, it's called a "Product" QMP.

Scope, Strategy and the Implementation of a QMP are the two major elements. They can be described as follows:

Scope: This defines what the QMP will cover and its duration. This scope can be used to determine activities for the first six-months of implementation of a QMP in your company.

Strategy: This describes the steps taken towards achieving the goals set forth in the scope.

A typical QMP has five phases: Planning (Design, Development), Implementation (Implementation), and Maintenance. Here are the details for each phase.

Planning: In this stage, the objectives of the QMP are identified and prioritized. To get to know the expectations and requirements, all stakeholders are consulted. Once the objectives and priorities have been identified, it is time to plan the strategy to achieve them.

Design: During this stage, the design team develops the vision, mission, strategies, and tactics required for the successful implementation of the QMP. These strategies are executed by creating detailed plans.

Development: This is where the development team works to build the capabilities and resources necessary for the successful implementation of the QMP.

Implementation: This is the actual implementation and use of the QMP's planned strategies.

Maintenance: The maintenance of the QMP is an ongoing task.

In addition, several additional items must be included in the QMP:

Participation of Stakeholders: The QMP's success depends on the participation of stakeholders. They should be involved in planning, design, development and implementation of the QMP.

Project Initiation. It is important to understand the problem and the solution in order to initiate any project. The initiator must know the reason they are doing something and the expected outcome.

Time frame: It is crucial to know the time frame for the QMP. A simple version is fine if you only plan to use the QMP for a brief period. You may need to upgrade if you plan on implementing the QMP for a long time.

Cost Estimation. Cost estimation is another crucial component of QMP. You cannot plan without knowing how much money you will spend. It is therefore important to calculate the cost before you start the QMP.

QMPs are not only a document, but also a living document. This is the most important aspect of QMPs. It changes as the company grows. It should therefore be reviewed frequently to ensure that the organization's needs are met.